Mastering Recessions Part III: Update on our machine-learned recession model

In June 2023, we published our US recession model which uses a machine learning model to predict the probability of recession within 6 months time. At that time, our model indicated a heightened recession risk. Next, we published some straightforward systematic tactical allocation models based on our recession prediction signal. You can read more about these models by delving into these posts.

As per October 2023, the models still flags a warning. The S&P 500 topped out in July 2023 and is currently in a weaker trend. In June of 2023, there was a lot of downplay going on about macro-indicators that signalled a potential weaker environment. Currently, we see a little bit more recession-awareness but consensus is still quite optimistic.

In our model, recession probability has come down fast over the summer, but it is still in the danger zone as we use a threshold of 10%. At 16% probability the model still indicates risk and last month the probability is going up again.

We have seen some improvement in indicators such as financial conditions, inflation, manufacturing sales and ISM-indices.

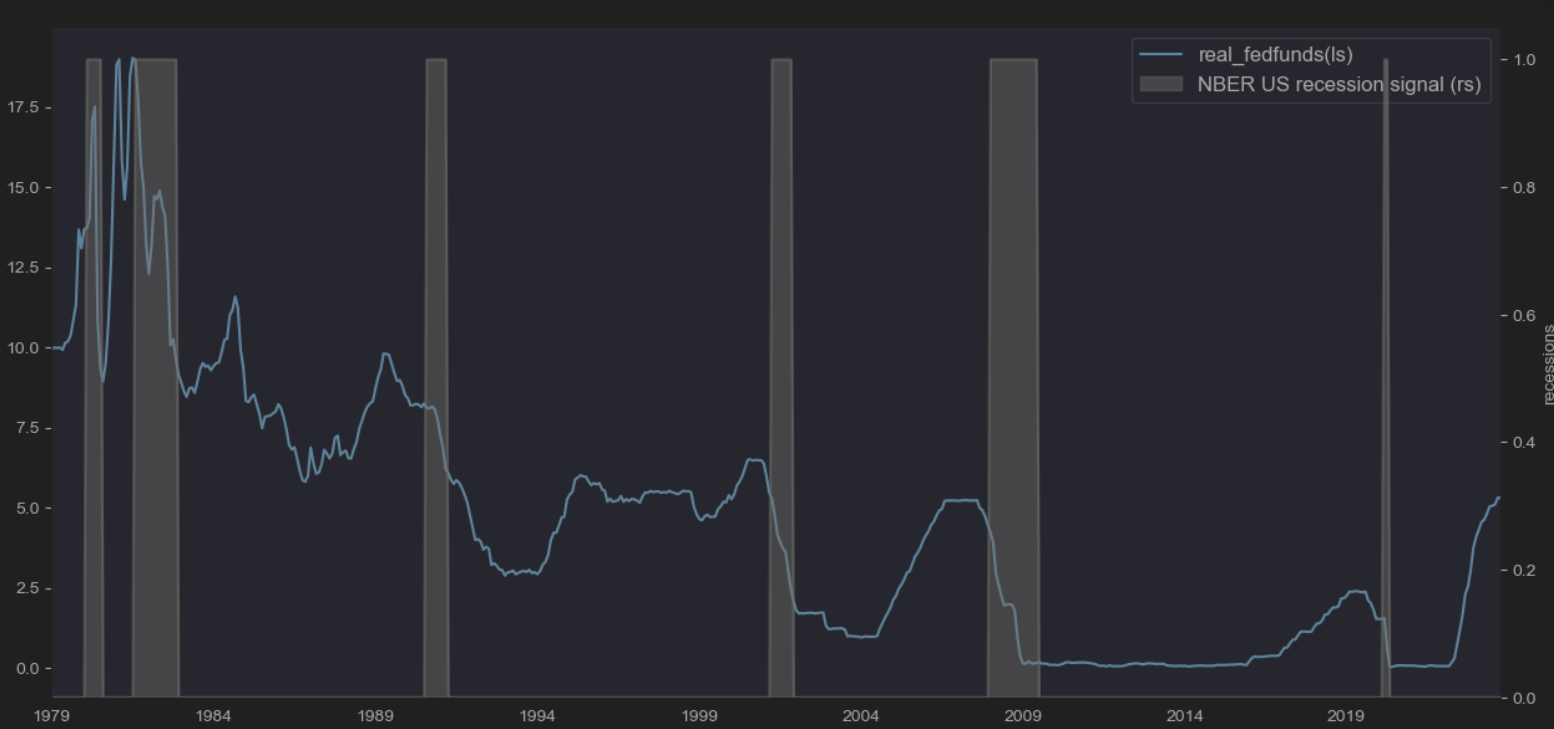

Nevertheless, some very important labour indicators continue to worsen. The US job market is clearly getting weaker and real interest rates are on the rise. For example, the real fed funds rate (adjusted for inflation) trades above 5%, a level that typically preceded previous recessions. High interest rates could still hurt consumers and businesses (especially with a wall of high yield refinancing coming up).

Although the probability of recession has come down due to some improvements in cyclical indicators and financial conditions, it is still elevated considering our danger-threshold of 10%. With labour market indicators weakening fast, we might still see elevated recession risks in the near future. Hence, we currently still prefer a defensive market positioning from a subjective global macro perspective.

As mentioned in one of our previous posts, it’s one thing to predict recessions but a whole other to predict how markets will react. History has taught us that recessions can even be accompanied by positive equity performance. You can read more about the systematic trading models we developed on our recession model here.